Logistics of a Lunging Market

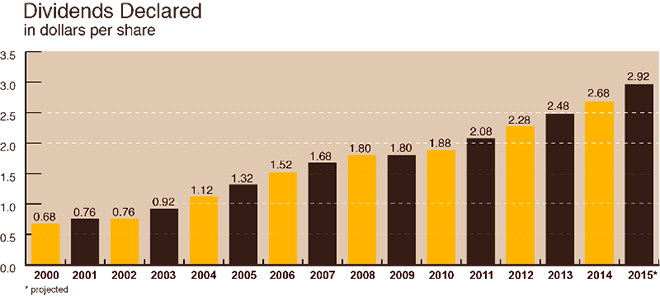

It hurts to see red, but what kills me more is getting left behind on a valued position when the market lunges back toward reason. I hope you weathered the year’s early volatility without losing sight of any valued holdings, I admonish individual investors to maintain cash and minimal margin going forward this year, we may not have seen the last chop. I was fortunate enough to not have any forced decisions during the most dire of this year’s downturns, thanks to discretion as to margin utilization. However, I certainly wished I had remained even a bit more cash heavy given the opportunities that abounded, and still do in many names. But limited resources is the name of the game and when it all comes down to it investing is investing because no one can buy it all, priorities must be made and capital risked. I was quite happy to enter ownership of a company that has been on my watchlist for some time, a domestic logistics force and growing global competitor, a company I deal with daily in my profession and have been impressed by their systems, support, infrastructure and staff. UPS became irresistible early this year and I opened a position which I plan to hold and grow. The stable cash flow, history of dividend increases, growing domestic demand and fairly ubiquitous presence of their service made this a must own for me. My decision was rewarded, as expected, with the first of many more dividend increases to come payable this February 2016. A great value name to add stable growth to the portfolio. Chart below from UPS Investor Relations shows a nice track record for ownership. I will be reinvesting dividends in this one for a time, as still a fair value, and looking to add as market allows. So far it has been a nice 9% ride up, plus dividend, over less than 2 months. Turmoil creates opportunity. The Investor’s job is to remain patiently ready.

UPS Dividend History