Logistics of a Lunging Market

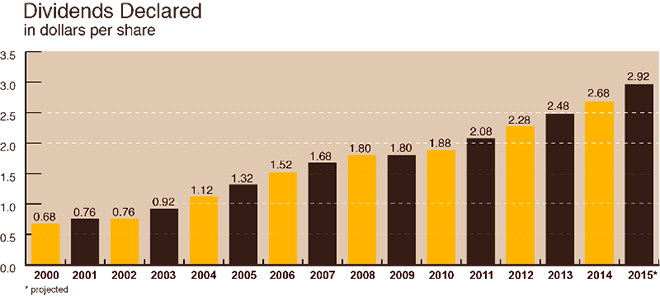

It hurts to see red, but what kills me more is getting left behind on a valued position when the market lunges back toward reason. I hope you weathered the year’s early volatility without losing sight of any valued holdings, I admonish individual investors to maintain cash and minimal margin going forward this year, we may not have seen the last chop. I was fortunate enough to not have any forced decisions during the most dire of this year’s downturns, thanks to discretion as to margin utilization. However, I certainly wished I had remained even a bit more cash heavy given the opportunities that abounded, and still do in many names. But limited resources is the name of the game and when it all comes down to it investing is investing because no one can buy it all, priorities must be made and capital risked. I was quite happy to enter ownership of a company that has been on my watchlist for some time, a domestic logistics force and growing global competitor, a company I deal with daily in my profession and have been impressed by their systems, support, infrastructure and staff. UPS became irresistible early this year and I opened a position which I plan to hold and grow. The stable cash flow, history of dividend increases, growing domestic demand and fairly ubiquitous presence of their service made this a must own for me. My decision was rewarded, as expected, with the first of many more dividend increases to come payable this February 2016. A great value name to add stable growth to the portfolio. Chart below from UPS Investor Relations shows a nice track record for ownership. I will be reinvesting dividends in this one for a time, as still a fair value, and looking to add as market allows. So far it has been a nice 9% ride up, plus dividend, over less than 2 months. Turmoil creates opportunity. The Investor’s job is to remain patiently ready.

UPS Dividend History

XOM – First and Last Post About Jim Cramer

Perhaps it is impetuous to declare this the last post on Jim Cramer speak, since it is in fact my first post here, but I am an investor of my word. Before today I had zero intention of ever writing back something Cramer reported on, but today a subtle aside of his on Mad Money drew my whole attention like no fast lipped blurb of his before. If you want to watch the clip first and guess at what caught my attention find link below, if you wish to read the entire post and then watch don’t clink (“click link”) now. Spoiler haters don’t worry, the topic that struck me was not mentioned in the video headline or the write-up! Some times the real news sneaks up when you’re not expecting it.

CRAMER – MAD MONEY December 14th, 2015

Cramer’s ramble picked up for me when he went to his second caller, Anthony in New Jersey. Anthony described how he had “just been scaling into XOM in the mid 70’s” and asked Cramer, “long-term will it ever… is it a forever stock, will it ever rebound?”

Cramer made NO hesitation, laying down the first chink I have seen in the status quo investment thesis that touts the blue chip fossil fuel producers as an investment for the ages,

“Long-term, you’re asking long-term after a climate conference where they basically said, listen, fossil fuels are going away. So the answer is, no. Not long term. Uh, we’re going to be changing our stance throughout 2016 on fossil fuels because of what’s happened with climate concerns around the globe. Because they basically decided it’s the end of fossil fuels. And if you’re thinking for your kids, you don’t buy.”

Wow! How is this not headline material?! While we are already hearing the left pine about how Paris didn’t go far enough, money is taking very serious note. With Buffet’s divestments from long time stake in XOM this year and now Cramer “changing stance” this here anonymous nature lover is starting to see economic incentives align with the moral imperative of environmental preservation in a big way. Interesting times to be an investor.

My Positions: Overweight solar for last two years.

Long: CSIQ, FSLR, JKS, SCTY

Short Puts: SCTY, SUNE